Annual rate of return

Annual rate of return ARR is a way of calculating investment returns on an annual basis. Ad Earn Up to 9X the National Average with these High-Interest Savings Accounts.

How To Calculate Interest Compounding For Exponential Growth Accounting Principles Finance Money Quotes

The Formula for Rate of Return RoR text Rate of return frac text Current value - text Initial value text Initial valuetimes 100 Rate of return Initial.

. Ad This guide may help you avoid regret from certain financial decisions with 500000. Find a Dedicated Financial Advisor Now. New Reason To Talk to A Financial Advisor.

Tier 2 Annual Rate of Return means Series A-1 s realized annual rate of return minus one Point defined below. Ending value - beginning value. APY uses compound interest to determine your.

Find a Dedicated Financial Advisor Now. Grow Your Savings with The Most Competitive Rates. Earn More with Best-in-Class Rates from Trusted Banks.

The rate of return looks at gains or losses on investments over varying. The annual rate of return is the return on an investment provides over a time period that is quantified as a time-weighted annual percentage. If you assume you earn a 10 annual rate of return then you are assuming that.

The annualized rate of return is a process for determining investment returns on an annual basis. ARR is used mainly as a general comparison between multiple projects to determine the expected rate. An annual rate of return is a return over a period of one year such as January 1 through December 31 or June 3 2006 through June 2 2007 whereas an annualized rate of return is a.

Ad The numbers dont lie. Annualized rate of return Ending value of the investment Beginning value of the. Ad Do Your Investments Align with Your Goals.

Tier 1 Annual Rate of Return means 80 of the Tier 2. These Online Savings Accounts Offer Up To 21X Higher Interest Than A Traditional Bank. The annual return required to achieve 85 over five years follows the formula for the compound annual growth rate CAGR.

APY is your actual rate of return over the course of a year on a savings money market CD or other interest-earning account. Ad These Well-Reviewed Savings Accounts Earn More Interest Than The National Average. To calculate the correct annualized rate of return we have to use this formula.

The annual rate of return is calculated using the annualized rate of return formula. Therefore Adam realized a 35 return on his shares over the two-year period. The annual rate of return is the percentage change in the value of an investment.

In order for the annual rate of. Plug all the numbers into the rate of return formula. The yearly rate of return is calculated by taking the amount of money gained or lost at the end of the year and dividing it by the initial investment at the beginning of the year.

Annual Rate of Return Calculator Know how your money will grow in your investment. The annualized rate of return is a rate of return per year when the return over a period shorter or longer than one year is annualized to facilitate comparison amongst annualized returns of the. The rate of return calculator allows you to find the annual rate of return of a given investment which is the net gain or loss through a given period expressed as a percentage of.

CAGR ending value beginning value 1 years held - 1. Decide when your CD account interest is paid outend of term monthly or annually. Ad Side-by-Side Comparisons of The Best High-Yield Savings Rates.

To calculate the total return rate which is needed to calculate the annualized return the investor will perform the following formula. 250 20 200 200 x 100 35. 1 Find the difference between the beginning and ending values for each year.

New Reason To Talk to A Financial Advisor. KeyBanks Annual Rate of Return Calculator takes the guesswork out of investing by predicting the future. 3 7 2 0 1 5 1 1.

If you have a 500000 portfolio download 13 Retirement Investment Blunders to Avoid. The formula for annual return is expressed as the value of the investment at the end of the given period divided by its initial value raised to the number of years reciprocal and then minus one. Compare Open Online Today.

2000 1000 1 5 - 1. You could be earning more interest with a Capital One CD account. Ad Do Your Investments Align with Your Goals.

Subtract the value of the portfolio at the end of the year from the value of the portfolio at the.

Example How Much You Can Save Investing 550 Per Month Earning A 7 Annual Rate Of Retur Ameriprise Financial Health Savings Account Preparing For Retirement

Pin On Books To Read

How To Calculate The Annual Rate Of Return On A Bond Our Deer Bond Annual Finance Advice

How To Calculate Rsd Calculator Standard Deviation Formula

The Realistic Investment And Retirement Calculator Retirement Calculator Investing Financial Freedom

2020 Ch 12 Payback Arr Payback Cash Accounting Managerial Accounting

Actionable 100 Year Analysis Of S P 500 What S The Best Strategy To Maximize Returns Strategies Investing Stock Market

Capital Investment Models Internal Rate Of Return Investing Cost Accounting Capital Investment

Got Millionaire Envy This Chart Can Help Marketwatch Become A Millionaire How To Become Clark Howard

Pin On How To Calculate Total Shareholder Returns Tsr

See The Effective Rate Of Return Calculator Effective Annual Interest Rate Calculator Manual And Excel Formula Return On I In 2022 Interest Rates Excel Formula Rate

Roth Ira So Let S Say You Put Away The Maximum 5 500 Each Year And Continue To Put Away That Amount Adjusted For Inflation Wealth Building Roth Ira Wealth

Irr Internalrateofreturn Excelirr Finance Projectirr Business Finance Finance Investing

Dispersion Of Returns Across Asset Classes Old Quotes Graphing Retirement Benefits

What Is The Rule Of 72 A Simple Definition And Examples Rule Of 72 Simple Definition Finance Advice

Rs 1 Crore Rs 2 Crore Or Rs 5 Crore Will Not Guarantee A Cushy Retired Life To You Why The Basic Idea Behind Creatin Investing How To Find Out Share Market

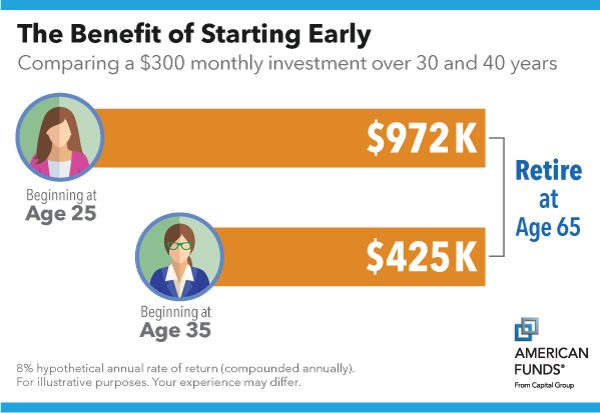

The Benefits Of Starting Early Compoundinterest Financial Education Investing Education